Drugs and finance can be observed as two incredibly distant disciplines. Maybe pension fund administration is exactly where the two disciplines uncover popular ground. When it will come to pensions, a finance practitioner have to be able to think and act with a very long-phrase goal in mind and to set the very well-getting of its shoppers earlier mentioned every little thing else, as a health care skilled would offer with a patient.

That popular floor is a solid basis for Stichting Pensioenfonds Medisch Specialisten (SPMS), the pension fund for self-utilized clinical professionals in the Netherlands, whose board is composed of nine physicians and is closely associated in the management of the fund.

There are quite a few features that set SPMS apart from other Dutch pension funds, commencing from the rather higher degree of hedging versus fascination-fee chance. Marcel Roberts, chief investment decision officer at SPMS, claims: “We hedge 78{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} of the liabilities’ fascination-price danger and that level has been at larger amounts for a decade now. We experienced such a substantial level of hedging even when interest costs ended up at rock bottom. Our board’s considering is quite a lot rooted in observing SPMS as extended-time period buyers.”

The hedging is implemented partly many thanks to a massive book of curiosity-charge swaps. The use of derivatives for pension possibility management needs came less than the spotlight at the finish of September previous yr. That was when outlined advantage pension strategies in the United kingdom have been caught up in a liquidity crisis, caused by a sudden increase of curiosity fees that forced them to put up collateral on their swaps all at the identical time.

Pension cash in the Netherlands, which also make comprehensive use of swaps, took discover. “We have been discussing irrespective of whether we ought to overview our collateral management approach and our hedging method more normally,” suggests Roberts.

He details out that Dutch pension resources are consistently requested to report on their derivatives portfolios by the Dutch central bank. The regulator needs to be certain, amid other points, that pension resources can fulfil their collateral management obligations.

“We have not produced any changes to our asset mix in our hedging tactic in response to what transpired in the Uk. Even so, we are thinking about adding a scenario with much larger fees and forex shocks to our stress-exam plan, vs . the present situations of the Dutch central lender, to make sure that we always have sufficient liquid belongings in our portfolio need to we have to have to write-up supplemental collateral,” Roberts suggests.

The Uk liquidity disaster prompted issues about collateral management but also about overall strategic asset allocation, adding to the uncertainty associated to pension reform in the Netherlands. SPMS, like numerous other pension money in the state, will have to look at what is the ideal amount of allocation to illiquid property.

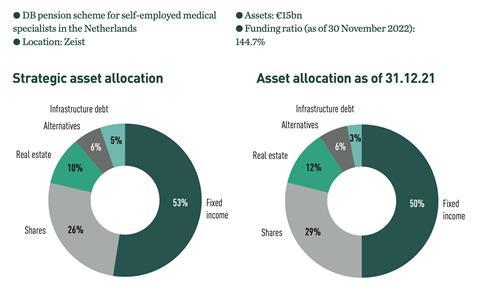

Stichting Pensioenfonds Medisch Specialisten (SPMS) at a look

Dutch pension resources experience a decision concerning in essence two preparations.

Which of the two preparations is much more conducive to expense in illiquid assets continues to be to be witnessed. “In anticipation of the new pension procedure, we are taking a break in phrases of new long-expression commitments to investments in illiquid belongings, at the very least till our contributors have chosen which system they want. For that reason it is way too early to say to what extent the portfolio will modify,” claims Roberts.

“In anticipation of the new pension system, we are getting a split in phrases of new long-phrase commitments to investments in illiquid assets, at least until eventually our participants have decided on which program they want. Thus it is also early to say to what extent the portfolio will change”

Marcel Roberts

The fund invests in real estate, infrastructure and hedge money. The latter is another aspect that sets SPMS aside from other Dutch pension money, most of which have divested from the sector. “Our allocation to hedge resources and non-mentioned genuine estate has served us perfectly this calendar year,” suggests Roberts.

Another crucial feature of SPMS is its indexation coverage. The fund was between just 21 – 10{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} of all Dutch pension resources – to raise gain ranges by at least 3{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} in 2022. Of those people 21 money, SPMS was the only non-enterprise pension fund to do so, along with a further fund, the pension fund for the inland delivery sector, Rijn- en Binnenvaart.

SPMS lifted pension gains by 4.25{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} in 2022, adding 1.25{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} to its fixed indexation ratio of 3{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac}. Roberts claims: “The large amounts of inflation in the Netherlands had been not the purpose why the fund resolved to increase gain ranges past its set ratio. The decision was rule-based, and had to do with the fund’s significant funding ratio of all over 145{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} by the conclude of 2022.”

There is no strategy to modify the indexation plan, which has traditionally been pretty generous in comparison with the industry conventional. Regardless of whether SPMS and its beneficiaries will continue to sense the pain of inflation stays to be seen, according to Ravien Sewtahal, investment manager at SPMS.

He claims: “The level of nominal fees in the coming years will be very dependent on the actual inflation results. We have some self confidence in the capacity of central banking companies to manage inflation. There is a discussion about whether or not central banking companies must raise their inflation targets. Though that may possibly not necessarily materialize, the debate suggests that central banking institutions may perhaps make it possible for inflation to keep a bit greater than it has been about the past 10 to 15 yrs.”

Nonetheless, the fund has not modified the asset allocation substantially based mostly on its views on inflation, according to Sewtahal. “One of the board’s expense beliefs is not seeking to consider a watch on where desire premiums will go, and in its place use a beginning level of staying fully hedged versus desire price hazard. On the other hand, the prospect of perhaps better than historic inflation, justifies not thoroughly hedging fascination fee possibility at the second.”

One particular area in which SPMS has designed significant alterations in the latest situations is sustainability. Sewtahal states: “Until 2020, our board was worried that concentrating on ESG conditions could potentially get in the way of achieving our goals. That has improved, and we have manufactured rather a turnaround in this area.”

The turnaround was these that SPMS was nominated, along with BpfBOUW, Bpf Detailhandel and PFZW, for the responsible financial investment/ESG prize awarded by PensioenPro, a sister title of IPE in the Netherlands. In the conclude, BpfBOUW won but SPMS values the final result nevertheless. Sewtahal claims: “The nomination has strengthened our belief that we are on the ideal keep track of.”

The fund has taken daring measures in sustainability in the place of a handful of years. In 2021, SPMS adopted a 2050 net-zero emission focus on as it grew to become a member of the United Nations’ Internet Zero Asset Proprietor Alliance (NZAOA). The pension fund also works with Local climate Motion 100+.

A amount of interim targets to arrive at that aim have been established. SPMS is using quite a few measures, together with placing a restrict to investment in providers that derive a big element of their profits from coal and tar sands. It has also adopted an exclusion policy for corporations connected to hashish and civilian compact arms, and has established boundaries on organizations that have out other kinds of violations, based on the UN World-wide Compact.

The fund is escalating its allocation to eco-friendly bonds and is in the approach of enforcing CO2-reduction targets in its mandates to fulfill its interim web-zero targets, the initially of which is in 2025.

SPMS also thoroughly studies on its engagement attempts, providing specific information on the initiatives it carries out collaboratively or on an individual foundation.

Probably the most notable determination was to allocate 10{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} of the assets to affect investments by 2025 at the most recent. Owing to its one-way links to the clinical profession, healthcare is one location in which SPMS hopes to attain effect, but local weather adjust is constantly at the major of the agenda. An internal dialogue is also having put on the value of biodiversity, in accordance to Sewtahal.

“Sustainability has been a video game changer in phrases of the way we pick out professionals,” he says. Even though BlackRock has acted as fiduciary manager of SPMS for a range of years, the board is eventually accountable and as this sort of is closely associated in the choice of the fundamental administrators, and thus supported by the executive business office, together with Roberts and Sewtahal, and the financial commitment committee.

“Until 2020, our board was anxious that focusing on ESG requirements could possibly get in the way of achieving our objectives. That has changed, and we have built fairly a turnaround in this area”

Ravien Sewtahal

“In 2022, we ran a lookup for an infrastructure credit card debt supervisor, and have been confronted with a decision in between a supervisor supplying environmentally friendly-power items labeled as Short article 8 beneath SFDR, and a person providing Write-up 9 items. There was a discussion inside of the financial investment committee on no matter if the influence-centered inexperienced-energy investments would provide related return opportunities to the non-influence kinds. In the conclude, the board chose the influence products,” suggests Sewtahal.

“The exact same occurred when we ran a search for a tough-currency emerging-market place personal debt mandate. There had been two choices on the table, a passive and an lively one. In the conclusion, the board of SPMS went for the energetic mandate, for sustainability good reasons. Though we believe passive investing in EMD would make sense, we considered the active manager would be far more successful in conditions of engagement.”

These examples exhibit how sustainability and ESG have come to be vital motorists in the way SPMS selects asset administrators, Sewtahal provides.

At the close of last 12 months, the fund was in the system of changing a hedge fund manager, and that is an asset course where acquiring managers with solid ESG qualifications is extra tricky, he admits. “For the bulk of the portfolio, we opt for ESG-compliant supervisors, based mostly on SFDR [Sustainable Finance Disclosure Regulation] and on how we level them in phrases of the ESG integration and expense method. For the hedge fund portfolio, we will have to be much more adaptable,” he claims.

Building a 10{7b6cc35713332e03d34197859d8d439e4802eb556451407ffda280a51e3c41ac} allocation to affect investments is proving a obstacle. The board made a decision to do so before the affect of the war in Ukraine was felt on the fiscal marketplaces. “We believe that achieving effect is more very likely in non-public marketplaces than in detailed kinds, but the scenario for investing in personal markets has modified completely from 2021. Because of to the fall in liquid markets, we have now attained our utmost allocation in private markets. For that reason it is difficult to commit to new investments”, states Sewtahal.

However, the most difficult activity is most likely defining the concept of affect investing. Sewtahal claims: “There is little settlement on what the definition of impact should be. SFDR aids to some extent, but it is getting increasingly difficult to use that as our only framework. The framework of the Global Affect Investing Community (GIIN) may well be much more beneficial.

“We will have to locate our way. Significantly, regulators are asking us to occur up with our have definition and conditions for examining and checking products and solutions and supervisors.”