Latest high food stuff cost inflation has plagued several Canadian households, primarily people on tight budgets. Studies Canada reported in Oct that in-retailer foodstuff costs improved at a more rapidly level than the all-objects Client Rate Index for the 11th month in a row.

The Ontario University student Diet Application, which feeds 28,000 students at 93 collaborating faculties, has been strike tough by inflation and is in require of additional funding and volunteers. The faculty breakfast that employed to price tag $1.20, now charges in excess of $2.

A latest examine from the non-gain Angus Reid Institute identified just about 60 for every cent of Canadians are having difficulties to present food stuff for their households. When they can find the money for to buy foods, quite a few can’t find the money for to acquire plenty of, or purchase the foods they want.

They stop up skipping foods, taking in previous and very low-top quality meals, browsing unique grocery shops to come across much less expensive alternatives, which benefits in insufficient nutrition. A Dalhousie University examine of 5,000 Canadians observed that 23.6 for each cent of the populace slice again food stuff buys and 7.1 per cent skipped foods due to inflation.

Around-paying out on food items

Normally speaking, reasonable inflation is not terrible. The Bank of Canada targets a two for each cent inflation price — the midpoint of its a person and three for every cent vary. The Lender of Canada influences the inflation price by manipulating the desire rate.

Nonetheless, the existing superior inflation is various — the Lender of Canada alone has acknowledged this. In a current speech, the central bank’s governor, Tiff Macklem, claimed, “high inflation is making lifetime extra complicated for Canadians, specifically individuals with very low or set incomes.”

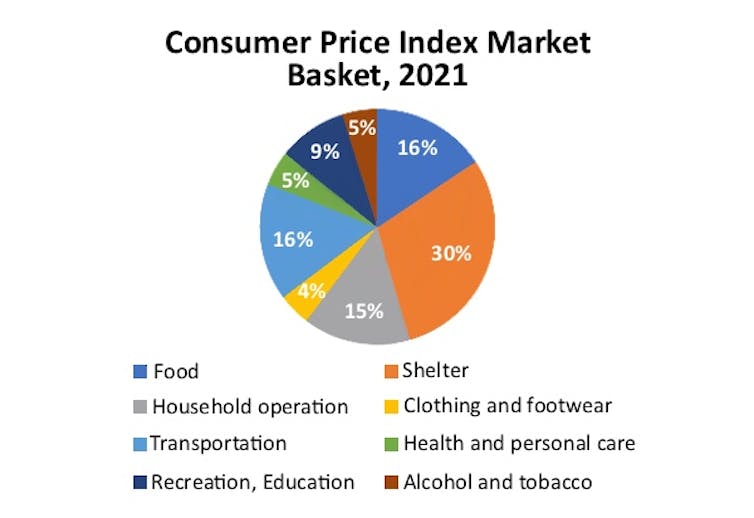

Food stuff, shelter and transportation account for more than 60 for every cent of a household’s expenses. If only food items costs ended up issue to higher inflation, homes would be ready to divert profits from shelter and transportation to address it. At the minute, even so, substantial inflation spans throughout all a few areas, which means Canadians are acquiring trouble putting foods on the desk, holding a roof around their heads and affording transportation.

(Data Canada), Writer provided

The volume of income that middle-cash flow homes spend on transportation and food stuff tends to make them susceptible. But the new interest rate increases are not serving to small-earnings people today both. Canadians spend the optimum proportion of their profits (practically just one-3rd) to hold a roof above their head. The new boosts in lending prices have driven up housing prices.

Canada’s Meals Price Report implies that, traditionally, Canadians shell out much less than 10 for each cent of their money on food items. But that has altered — Canadians now invest 16 for every cent of their earnings on foodstuff. The report also states that the foodstuff inflation index has outpaced typical inflation over the last 20 yrs. The selling price of a normal grocery bill rose by 70 per cent between 2000 and 2020.

Canadian well being suffering

A critical side-outcome of soaring food value inflation is its effects on well being and nourishment. When the cost of foods improves, it restricts the availability of healthy foodstuff for reduced-revenue people today. At some point, this can guide to very long-time period impacts on human health and fitness and puts additional stress on Canada’s already strained overall health-care system.

According to research from the University of Toronto, an insecure food offer will increase vulnerability to a variety of ailments and wellness conditions, which include infectious conditions, bad oral overall health, accidents and serious problems like despair and anxiety, heart sickness, hypertension, arthritis and persistent pain.

THE CANADIAN Push/Graham Hughes

In the same way, a examine by researchers from the Harvard Center for Population and Enhancement Experiments, discovered that nourishment, specifically in the postnatal point out, is the most crucial element impacting human expansion. This suggests that shorter adult height in lower- and middle-money nations is joined to environmental problems like diet.

We want to fork out particular interest to food stuff price inflation due to the fact it has the likely to have extended-lasting results on potential generations’ actual physical and psychological wellbeing. Our little ones are our long run — we have no room for compromise with their foods and diet. Today’s malnourished small children will end result in tomorrow’s malnourished country.

Co-ordinated energy needed

It is important to make policymakers and governments aware of this devastating circumstance so they can get the important methods to beat soaring food stuff price ranges. Governments and policymakers ought to make certain Canadians have accessibility to economical, nutritional meals.

As a quick-term solution, Canadians need to think about shopping for seasonal and frozen foods, growing foods on their own and replacing meats with legumes. To deal with foods selling price inflation from a systemic viewpoint, policymakers really should index social welfare amounts with inflation as promptly as doable to protect against unpredictable food stuff selling price hikes for social welfare recipients.

Last of all, corporations should not get benefit of people’s desperation by escalating food items selling prices. Canada’s a few largest grocery chains have been publishing large profits not too long ago. They could use these gains to offset some of the price tag of meals value inflation. There is no silver bullet for tackling the large foods price tag inflation correctly, but it will need a co-ordinated hard work from all sides — governments, companies and households.